Off-exchange Trading in Modern Equity Markets

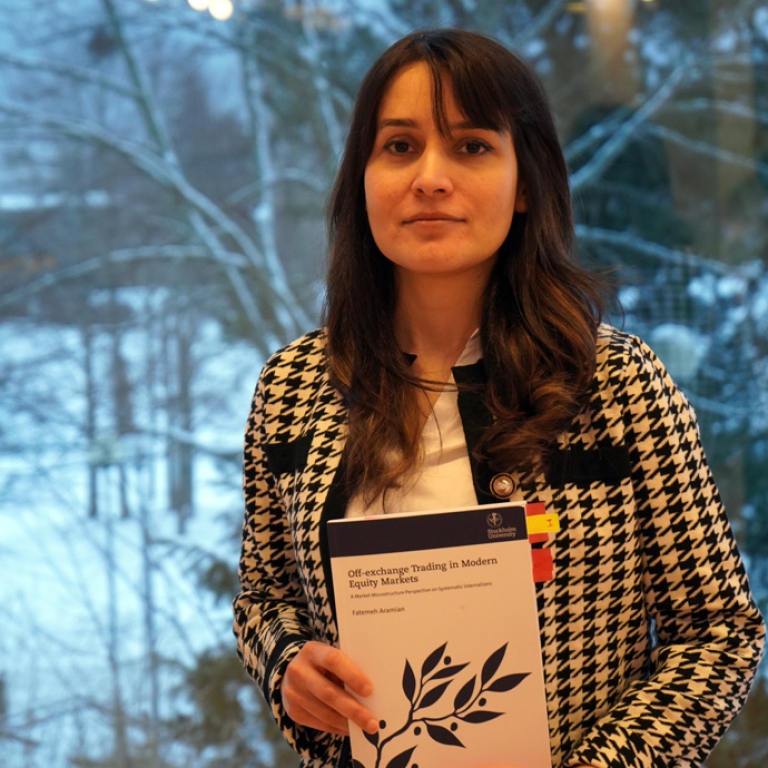

We congratulate Fatemeh Aramian who defended her dissertation "Off-exchange Trading in Modern Equity Markets: A Market Microstructure Perspective on Systematic Internalizers" on January 10th at the Finance section, Stockholm Business School.

Fatemeh Aramian has M.Sc. in financial mathematics and a B.Sc. in mathematics. Her master’s studies gave her theoretical knowledge in finance and financial modeling.

- It also helped me to realize that I would like to pursue my education. Hence, I applied for a Ph.D. position in finance at SBS says Fatemeh.

How did you choose your subject for the dissertation?

My research interest is within the field of market microstructure. At the time I was preparing my Ph.D. thesis proposal, European financial markets were undergoing an overhaul in regulation through the regulatory reform of Markets in Financial Instruments Directive (MiFID) II.

MiFID II has been the most important event European markets have experienced during the last decade. One of the main and instance outcomes of the regulation was the rapid growth in off-exchange trading through systematic internalizers (SIs).

The importance of off-exchange trading and the growing concerns about the increased market share of SIs motivated me to study the role of off-exchanges trading in equity markets in the post-MiFID II period with a focus on SIs.

Can you tell us about the conclusions you made in your dissertation?

I have written a compilation thesis. As a collection of three articles, my dissertation examines how SIs affect inter-market competition, traders’ order routing decisions, and ultimately, various aspects of equity market quality.

The thesis indicates that SIs have both substitutionary and complementary roles to public stock exchanges. Specifically, the thesis shows that SIs are substitutes to exchanges since traders choose to trade on SIs when liquidity and volatility are low on exchanges. SIs also complement exchanges as they can attract large traders who cannot execute their large orders on exchanges.

I also find a trade-off between market efficiency and liquidity in the presence of SIs alongside exchanges. The trading activity of SIs improves market efficiency, whereas their activity, in particular the activity of those SI run by high-frequency traders, harms liquidity.

What has been easy or difficult in your work with the dissertation?

I think developing interesting research ideas that contribute to academic research, provide insights for future regulatory policies and are informative to practitioners is very important and can be challenging.

Conducting research in finance, especially in market microstructure depends heavily on working with large amounts of data. Working with data and performing different analyses were the fun parts and very enjoyable to me.

Last updated: January 21, 2022

Source: SBS